Sample Charitable Donation Receipt

There are tax consequences as well. Further this helps you can maintain a strong relationship with your congregation and.

30 Non Profit Donation Receipt Templates Pdf Word Printabletemplates

Payroll Deductions For charitable contributions made by payroll deduction the donor may use a pledge.

. Sample 501c3 Donation Receipt DONATION RECEIPT. Such documents are used by non-profits and charitable outlets. In addition IRS regulations require that before a donor claims a tax deduction for a charitable contribution the donor must have a bank record or a written communication from the charitable nonprofit documenting the contribution.

Donation letters also known as appeals are a tool nonprofits use to entice prospective supporters to donate. Whether you are crafting an email to potential donors a social media post an invitation or the donation page for your website your wording impacts the outcome. And you must provide a bank record or a payroll-deduction record to claim the tax deduction.

Across all States churches fall under the umbrella of a 501c3 tax-exempt organizations meaning that any individual who makes a charitable donation to a church can deduct the total value of the gift from their annual income when filing their taxes. The IRS will require proof of every charitable transaction and the donation receipt is that proof. Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview.

16 Sample Receipt Forms. Your receipt may be used by your donor to show they made charitable donations throughout the year. A donation receipt is a record of acknowledgment used for indicating acceptance and that the funds or goods donated were received.

Youll want to make sure you have everything necessary in their receipt so they can use it for. Secondly for taxpayers who do not itemize deductions the Act allows up to 300 in charitable donation deductions. As a result donors expect a nonprofit to provide a receipt for their contribution.

Call 1-800-SA-TRUCK 1-800-728-7825 to find out if pick-up service is available in your area and to schedule a date and time. Free donation receipt templates available for Excel and Google Sheets. Free eCards Online ThanksWere all in hurry and e-mail is by far the quickest way to send thank you notes to family and friends whom you see often.

If an organization is certified 501c3 as most well-known charitable organizations are its safe to give a donation knowing that it can be tax-deductible. All charitable contributions need receipts that accurately reflect the value of the contribution. XXX The serial number of the receipt.

Updated June 03 2022. Nonprofit Purpose This corporation is organized exclusively for charitable religious educational and scientific purposes including for such purposes the making of distributions to organizations that qualify as exempt organizations under section 501c3 of the Internal Revenue Code or the corresponding section of any future federal tax code. General Income Tax and Benefit Guide.

Now its time to start writing your own donation letter. Sample Deposit Receipt Form. Rules Around Donation Tax Receipts.

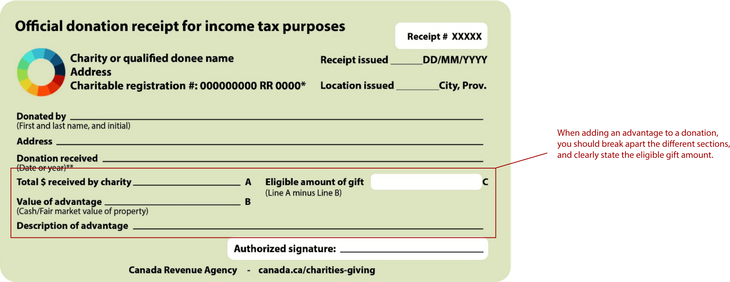

National Park Foundation Attn. You cant claim a charitable tax credit or deduction unless you have an official donation receipt. The donors name address programme listing and other details are included here.

If the IRS qualifies the organization receiving the donation as having tax-exempt status the donation receipt is then used to claim a deduction on the donors income tax return. IRS Publication 4302 A Charitys Guide to Vehicle Donation and IRS Publication 4303 A. In most years as long as you itemize your deductions you can generally claim 100 percent of your church donations as a deduction.

With all the necessary fields simply download print and use. 4th of July BBQ Thank You Notes Writing samples for thank you cards for 4th of July BBQ Parties. Ask if there are any circumstances where you wont receive an official donation receipt.

One of the most critical factors in fundraising is the wording you use to ask for donations. Single donations greater than 250. These changes apply.

Letter of Donation Sample. Goodwill Industries of Northern New England. Top 10 Thank You Gift IdeasTop 10 ideas for popular thank you gifts most people would enjoy receiving.

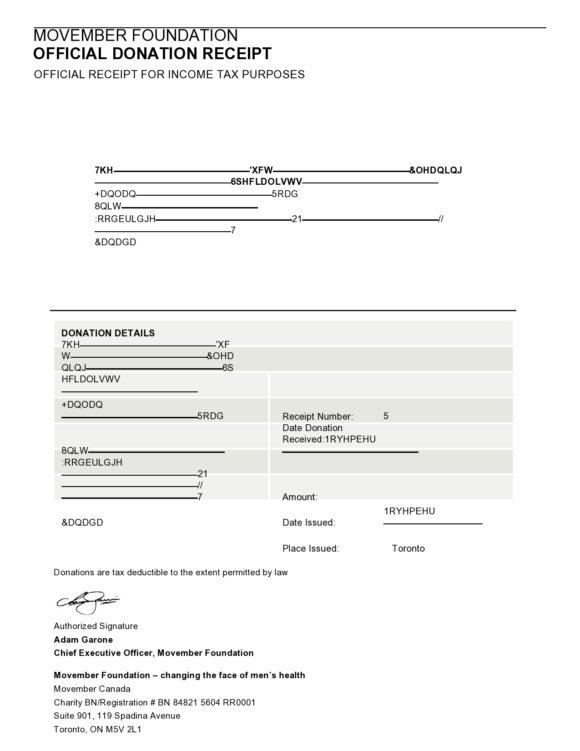

If your church operates solely for religious and educational purposes your donation will qualify for the tax deduction. How you ask is just as important as who you ask to support your organization. Official donation receipt for income tax purposes A statement that identifies the form as an official donation receipt for income tax purposes.

This can be achieved by automating the process of issuing donation tax receipts more on this below. A thank you letter for a donation has to do more than just make the donor feel good. Instead of creating from scratch you can get and use these donation receipt templates for free.

Donation Letter Template Sample for Individuals and Corporations. The Salvation Army is a large organization that offers rehabilitation services to adults youth and families. You are required to record the mileage.

It operates thrift stores throughout the United States and is happy to accept quality furniture donations. Dear Animal Rescue. This Sample Donation Forms is used by organizations for donating money to other institutions.

You need a receipt and other proof for both of these. It acknowledges that a gift was made to you and that the receipt contains the information required under the Income Tax Regulations. To donate by phone or for assistance with a donation please call.

Donations must be cash or the equivalent and given to a qualified charity 501c3. Eligible donations of cash as well as items are tax deductible but be sure that the recipient is a 503c3 charitable organization and keep donation receipts. Name of the Non-Profit Organization.

1216 Cottonwood Lane Nashville TN 37203. When you prepare your federal tax return the IRS allows you to deduct the donations you make to churches. A church donation receipt is a record of a charitable donation that has been made to a church.

As a receipt or letter showing the name of the charity the date of the contribution and the amount of the contribution. Most of the time they include a written ask for either financial support or an in-kind gift. As Hamza Yusuf said.

The IRS requires donation receipts in certain situations. P113 Gifts and Income Tax. Box 17394 Baltimore MD 21298-9450.

So its advised to send out a donation receipt within 24-48 hours of the donation being made. Download donation receipt template 11 83 KB Download donation. If claiming a deduction for a charitable donation without a receipt you can only include cash donations not property donations of less than 250.

To donate by check please complete this form and mail your donation to the address below. Donation Pledge Form Sample. For example someone who wishes to give a sum of money or property to a charitable organization may send a letter accompanying their donation including their personal details and a short note about the reasons why they chose to give.

To get you. Thanking your donors for their contributions and letting them know how grateful you are for their support is a key element of successful church donation letters. Sample official donation receipts.

30 Non Profit Donation Receipt Templates PDF Word In. This helps your church members to feel valued and involved in the work your church is doing. Sponsorships and money in other forms for.

Free Donation Receipt Template 501 C 3 Word Pdf Eforms

Free Donation Receipt Template 501 C 3 Word Pdf Eforms

Charitable Donation Receipt Template Printable Pdf Word

Free 10 Charity Donation Receipt Samples Templates In Pdf

Nonprofit Donation Receipts Everything You Need To Know

Free Donation Receipt Templates Samples Word Pdf Eforms

Donation Receipt Template Pdf Templates Jotform

Comments

Post a Comment